Straight line method of depreciation example

This depreciation method is appropriate where economic benefits from an asset are expected. Your party business buys a bouncy castle for 10000.

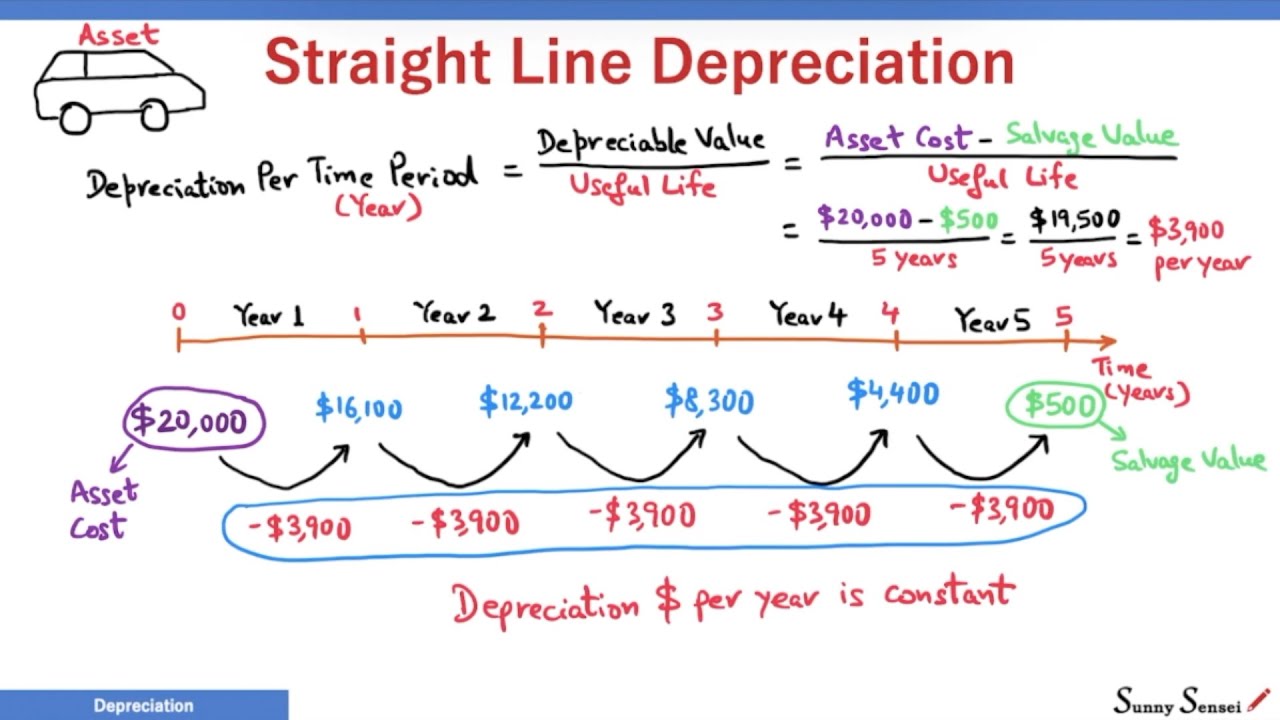

Depreciation Formula Calculate Depreciation Expense

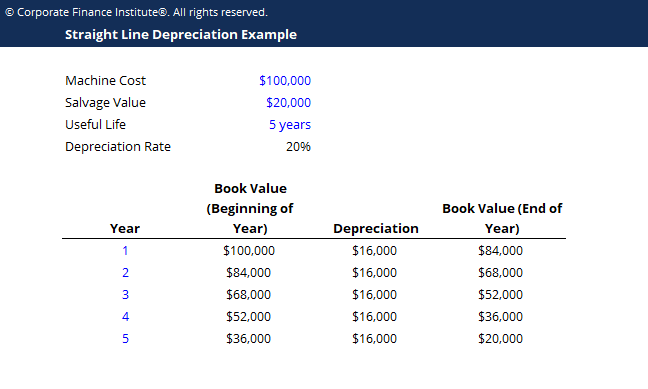

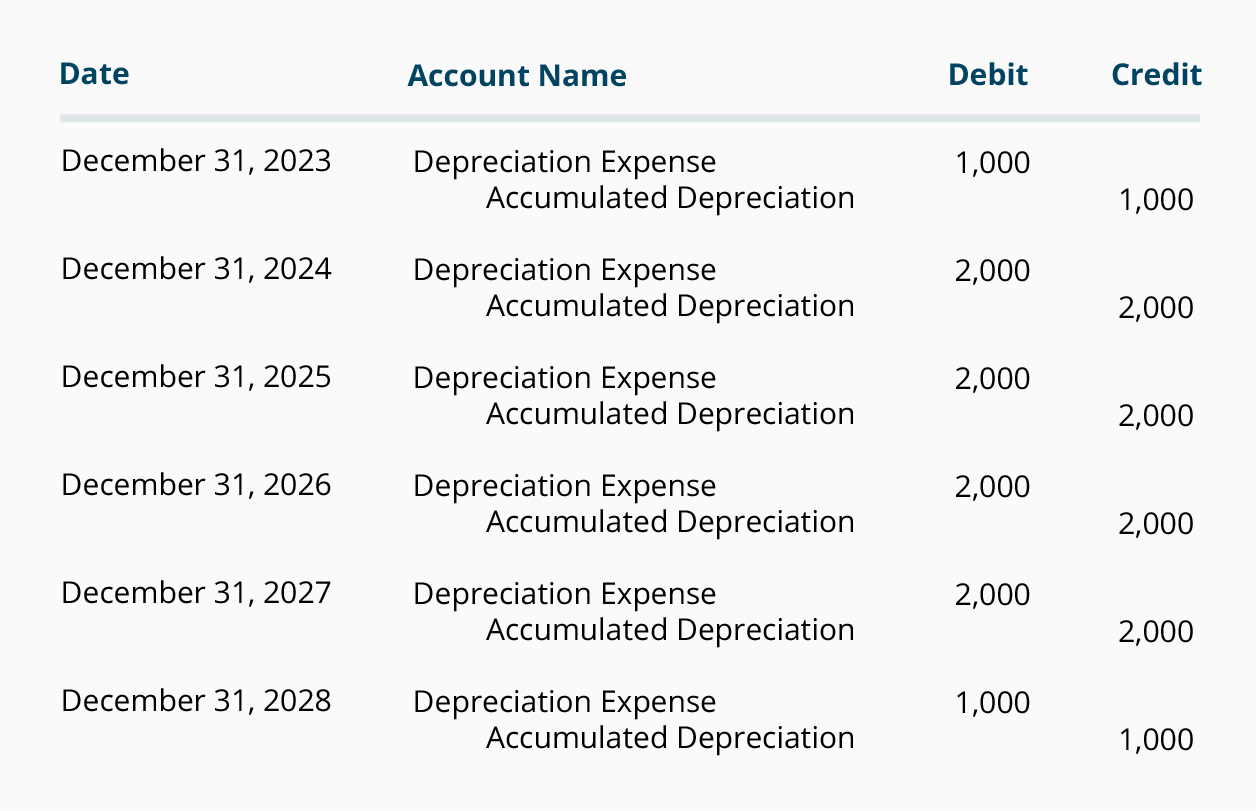

Now lets consider a full example of a finance lease to illustrate straight-line depreciation expense.

. This article gives an overview of the Straight line service life method of depreciation. Here is the example of deprecation expenses charged based on the straight-line depreciation method. Straight-line depreciation with a finance lease.

Straight Line Depreciation is a depreciation method used to calculate an assets value that reduces throughout its useful life. Straight Line Method of Depreciation. Straight-line depreciation is a method of determining the amortization and depreciation of an asset.

Example of Straight Line Depreciation Method. Straight-line is a depreciation method that gives you the. The sale price would find its way back to.

When you set up a fixed asset depreciation profile and select Straight line. Has purchased 2 assets costing 500000 and 700000. A company has purchased an equipment whose first cost is Rs.

This method assumes that the. In year one you multiply the cost or beginning book value by 50. Straight Line Depreciation Method Examples.

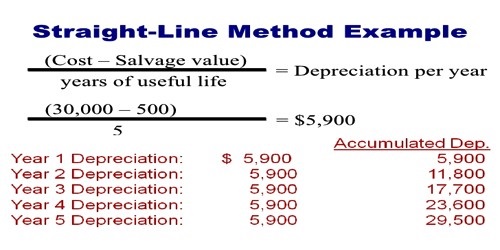

The most common forecasting methods for depreciation are. Straight Line Method SLM According to the Straight line method the cost of the asset is written off equally during its useful life. The four main depreciation methods mentioned above are explained in detail below.

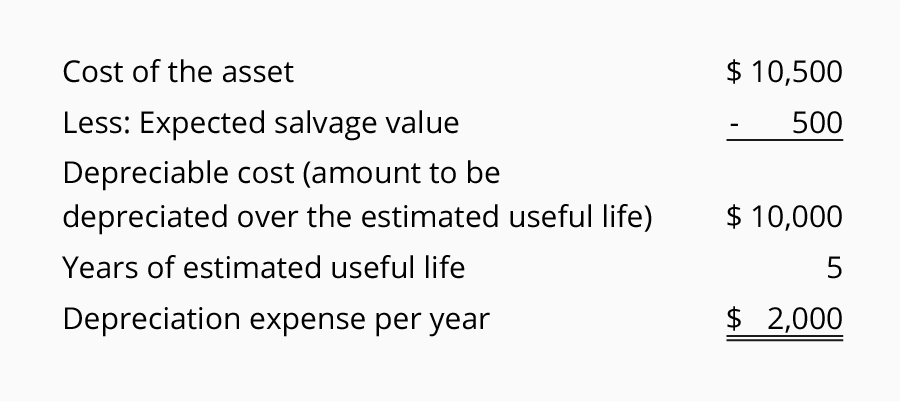

The salvage value of asset 1 is 5000 and of asset 2 is. The straight-line method of depreciation attempts to allocate equal portion of depreciable cost to each period of the assets useful life. Lets take a simple example to understand how the straight-line depreciation works Ajay blade works purchased a machine.

The DDB rate of depreciation is twice the straight-line method. In this article. That determines how much depreciation you deduct each year.

Depreciation Expense Cost Salvage ValueUseful life. 200000 with an estimated life of ten years. You then find the year-one.

For example the company just purchased a car for admin staff use cost 55000 USD. In year one you multiply the cost or beginning book value by 50. In the straight line method of calculating depreciation a constant depreciation charge is made every year on the basis of total.

Example of straight-line depreciation without the salvage value. Straight line depreciation method charges cost evenly throughout the useful life of a fixed asset. The straight-line depreciation method is the most.

To illustrate this we assume a company to have purchased equipment on January 1 2014 for 15000. The depreciation expense would be completed under the straight line depreciation method and management would retire the asset. Therefore an equal amount of depreciation is charged every.

This calculation allows companies to realize the loss of value of an. Example problem on straight line method of depreciation - 2. Straight Line Method of Depreciation - Example.

Purchase price and other costs that are necessary to bring assets to be ready to use. Straight-line depreciation is a very common and.

What Is Straight Line Depreciation Method Pmp Exam Youtube

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Straight Line Depreciation Template Download Free Excel Template

Depreciation Methods Principlesofaccounting Com

Straight Line Depreciation Accountingcoach

Depreciation Methods Straight Line Sum Of Years Digits Declining Balance Calculations Youtube

Depreciation Expense Double Entry Bookkeeping

Straight Line Method For Calculating Depreciation Qs Study

Straight Line Depreciation Method Formula Example Video Lesson Transcript Study Com

Straight Line Depreciation Double Entry Bookkeeping

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Vs Reducing Balance Depreciation Youtube

Method To Get Straight Line Depreciation Formula Bench Accounting

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Formula And Calculator

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Calculation Explained With Example

How To Calculate Straight Line Depreciation Depreciation Guru