Calculate my tax refund

Attach Schedule 8812 Form 1040 to Form 1040 US. 18 cents per mile.

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax refund time frames will vary.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. Tax refund time frames will vary. TOP will deduct 1000 from your tax refund and send it to the correct government agency. The notice will include information on the refund you were eligible for the amount your tax refund was reduced by what agency the money was sent to and contact information for that agency.

The graphics and sliders make understanding taxes very easy and it updates your estimate as you add in information. Family Leave benefits are paid until you. The tax refund calculator shows your ATO tax refund estimate.

The depreciable basis is generally the lesser of adjusted basis or FMV of the property at the time of conversion. TaxHelpWVGov 2020 State Tax Filing Deadline. Tax Return for Seniors or to Form 1040-NR US.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up. Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style. Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

Please wait at least eight weeks before checking the status of your refund. 16 cents per mile. The IRS will be issuing refunds of up to 12 billion to a total of 16 million qualifying individual taxpayers Form 1040 and businesses Form 1120 who filed their 2019 or 2020 taxes late.

But since the Premium Tax Credit is meant to help families afford health insurance you may want to save the money and fill out the form yourself. The results do not include special local taxessuch as admissions entertainment liquor lodging and restaurant taxesthat may also apply. This tax applies only to income above a certain threshold below this threshold only the normal 14529 rate is applied.

Our tax refund calculator will do the work for you. The application will provide definitions explain the assistance process in detail and will specify exactly what information must be provided andor submitted. Apply additional Medicare tax of 09 if you are a high earner.

Medical and moving mileage. Fastest tax refund with e-file and direct deposit. I was thankful to the one who assisted me as I process my tax refund.

While they seem complicated IRS instructions are actually quite clear. Fastest refund possible. TurboTax Tax Refund Calculator.

Get your tax refund up to 5 days early. Youll fill out basic personal and family information to determine your filing status and claim any dependents. No federal income tax is withheld from your benefits unless you request a 10 percent deduction when you apply.

The information needed include. Fastest federal tax refund with e-file and direct deposit. The other sections will calculate your taxable income and find credits and deductions you can claim on your return.

Tax Refund Offset Reduced Refund via Treasury Offset Program A major reason why some folks refund is actually less than the amount they were expecting or provided by their e-filing tax provider is that the federal government has offset or deducted monies from your tax refund to cover debts you owe other federal agencies. Fastest refund possible. In case you additional materials for your assignment you will be directed to manage my orders section where you can upload them.

Use our quick tools to find locations calculate prices look up a ZIP Code and get Track Confirm info. Get your tax refund up to 5 days early. In addition the Department is in the process of developing the application that will be submitted to apply for assistance through the COVID-19 Retail Storefront Property Tax Relief Act.

Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. Nonresident Alien Income Tax Return. 56 cents per mile.

The more details you add to your tax return the more accurate the tax calculator becomes It is accurate to the cent based on the information you add to your return and it updates as you go. Use our Free Canadian Tax Refund Calculator to calculate your refund. You were going to receive a 1500 federal tax refund.

The West Virginia state income tax is similar in structure to the federal income tax. 1-800-982-8297 Email Tax Support. 585 cents per mile.

You also give your assignment instructions. This entry was posted in TaxTims Blog and tagged Audit Verification SARS eFiling. But you are delinquent on a student loan and have 1000 outstanding.

The IRS announced that they will be providing Covid tax relief for certain 2019 and 2020 Returns due to the pandemic. 2021 tax return due in 2022 2022 tax return due in 2023 Business mileage. How do I calculate my estimated tax refund.

It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund. Return to work exhaust your maximum benefit entitlement your childs first birthday 12 months after adoptive or foster placement or your family member no longer needs care. For property that has changed from personal to business use the basis used to calculate depreciation ie.

West Virginia Tax Brackets. The threshold varies based on your filing status. An excellent tool is the TurboTax tax refund calculator.

When you sell the property the basis reported on your tax return depends on whether the property is sold at a gain or loss. The IRS issues more than 9 out of 10 refunds in less than 21 days. Of course using tax preparation software like TaxAct or HR Block or a tax accountant will simplify filling out Form 8962.

Important IRS penalty relief update from August 26 2022. Tax refund time frames will vary. Heres an example.

14 cents per mile. Refer to Part III of Schedule 8812 to calculate an additional tax if you received excess advanced CTC payments during 2021. Estimating your tax refund or balance owed does not have to be complicated.

Wealthy individuals have to pay a small additional 09 tax on top of the normal Medicare tax. Typically the IRS will mail you out a notice if your tax refund is different from the amount you claimed on your tax return. Individuals will calculate Additional Medicare Tax liability on their individual income tax returns Form 1040 or 1040-SRusing Form 8959 Additional Medicare Tax.

Additional Medicare Tax to document the withholding and to receive a refund of any tax that was withheld in excess of the total tax owed on your individual income tax return. Customer service and product support hours and options vary by. 14 cents per mile.

The only way you can get an income tax refund get tax back from SARS is to complete and submit your tax return. Average tax refund for Canada is 998 - get your Canadian Tax Back Now. To find out the status of your refund youll need to contact your state tax agency or visit your states Department of Revenue.

Use TaxTim to make the process simple and get your maximum possible tax refund this tax season. If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive. Find information on our most convenient and affordable shipping and mailing services.

Fastest tax refund with e-file and direct deposit. The IRS issues more than 9 out of 10 refunds in less than 21 days. Fastest Refund Possible.

Etax includes the all tax cuts and tax rebates in your refund estimate for 2022. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up. The IRS issues more than 9 out of 10 refunds in less than 21 days.

Individual Income Tax Return Form 1040-SR US. It was a great service. Just enter your information and get an estimate of your tax refund.

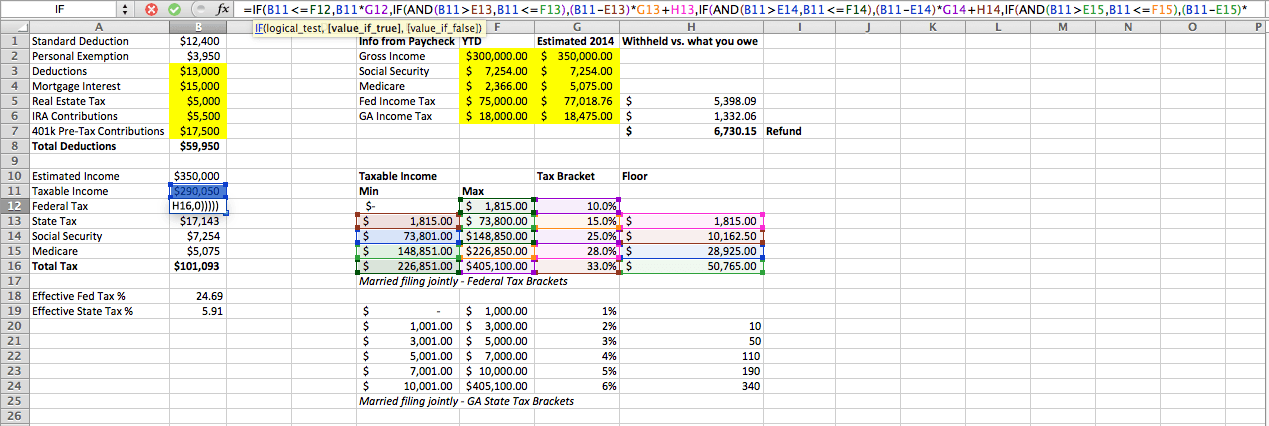

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Hmrc Tax Refund Calculator Will Guide You To Understand Whether You Are Eligible For A Refund From Hmrc Or Not Sinc Income Tax Return Income Tax Tax Return

Calculating Income Tax Payable Youtube

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Excel Formula Income Tax Bracket Calculation Exceljet

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

How To Calculate Taxable Income H R Block